small smiles/iStock by way of Getty Pictures

Qorvo (NASDAQ:QRVO) is predicted to make a fortune providing wi-fi and wired connectivity within the new period of the IoT and 5G. I consider that the corporate’s income development and FCF margins will impress market members. With that, in my opinion, the inventory could not come as much as the wants of each investor. I’ll purchase shares as a result of, for me, the truthful worth is $193. Nevertheless, my DCF mannequin additionally confirmed that beneath the worst-case state of affairs, the inventory worth might decline to $135. Presently, QRVO trades at $150-$160.

Qorvo Presents A Response To The Demand From The IoT And 5G Revolution

Qorvo develops and sells applied sciences for wi-fi and wired connectivity:

Supply: Firm’s Web site

I consider that it’s the finest time to take a look at Qorvo’s enterprise mannequin. Have in mind that almost all mobile operators are quickly transferring to 5G, and plenty of of them would require new infrastructure RF merchandise like Qorvo’s high-performance gallium nitride, gallium arsenide, and bulk acoustic wave merchandise. Will probably be completely essential for the operators to change their applied sciences as a result of 5G networks function on completely different frequencies. It’s a full change of methods from the earlier 4G architectures.

That is not all. With the expansion of the Web of Issues, an increasing number of purposes, and industrial gear linked, customers will want ultra-low energy wi-fi options. Qorvo’s multi-protocol with Bluetooth low vitality, Zigbee, and thread options seems to be a wonderful response to the brand new demand from linked clever gadgets.

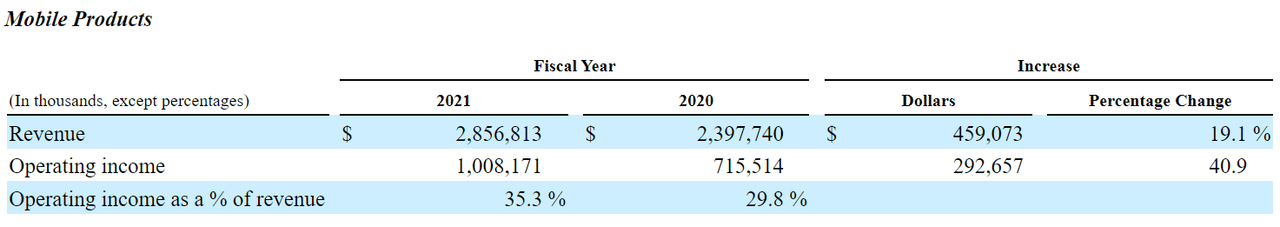

With all of the earlier info in thoughts, it is sensible that the corporate’s enterprise segments are reporting vital gross sales development. The cell merchandise enterprise phase stories 19% gross sales development and an working revenue of 35%-29%:

Supply: 10-Okay

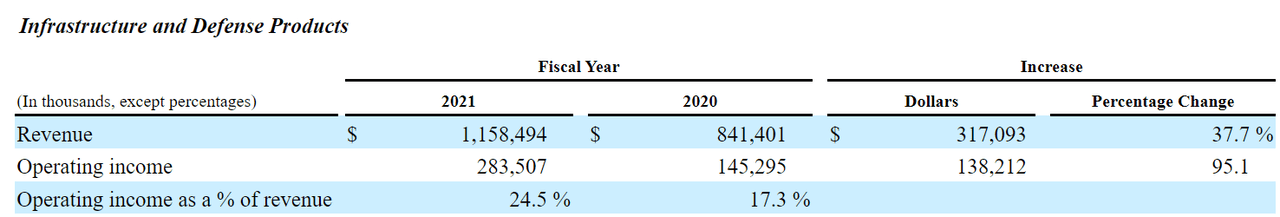

With respect to the infrastructure and protection merchandise, the corporate reported 37% gross sales development in 2021, and an working revenue margin value 24%:

Supply: 10-Okay

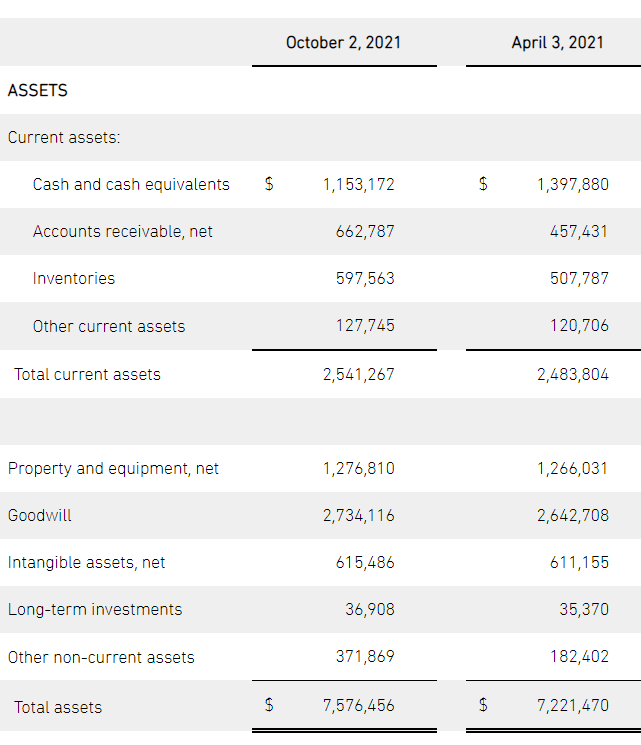

Qorvo Stories A Massive Quantity Of Money In Hand

As of October 2, 2021, the corporate reported $1.1 billion in money with an asset/legal responsibility ratio of greater than 2x. For my part, the corporate’s monetary state of affairs is kind of wholesome. Qorvo stories a considerable amount of money, which may very well be used to finance the event of latest applied sciences and advertising and marketing efforts:

Supply: 10-Q

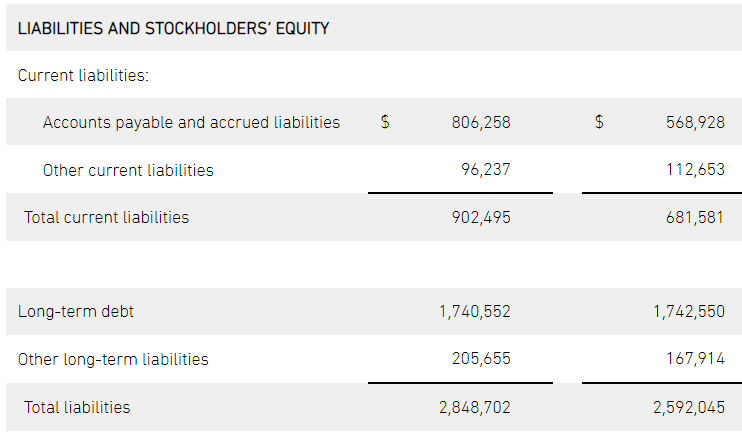

Qorvo can be financing a few of its operations with debt. As of October 2, 2021, the overall quantity of long-term debt was equal to $1.7 billion. The corporate’s web debt is near $0.5 billion, which doesn’t appear vital. Think about that I’m anticipating FCF to be equal to $1.5 billion in 2025:

Supply: 10-Q

DCF Mannequin With 16%-9% Gross sales Progress And EBITDA Margin Of 31%

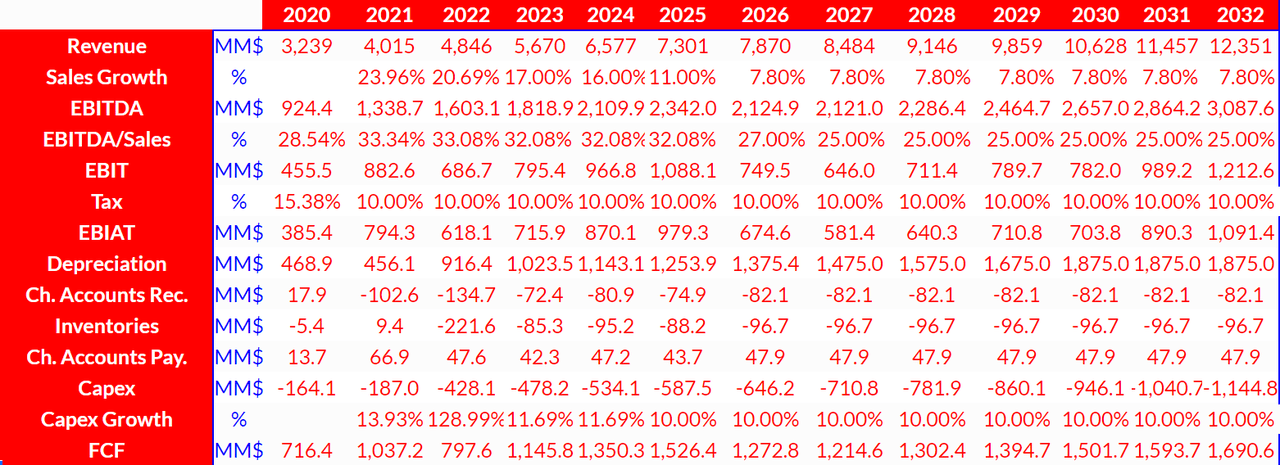

With the administration noting that Qorvo will almost certainly ship 15% gross sales development and a gross margin of round 52%, I designed my very own DCF mannequin. I additionally rigorously studied the expectations of different analysts, that are fairly optimistic. After all, I do know that the continuing provide challenges could affect the corporate’s profitability within the coming years. Nevertheless, I would not count on issues to persist from now till 2032:

After attaining a document September quarter, we count on December quarter income to lower sequentially amidst ongoing provide challenges and different elements impacting international smartphone demand. Within the March quarter, we count on these challenges to reasonable. We count on our full fiscal yr 2022 to develop 15% and to ship a gross margin of over 52%. Supply: Press Launch

If Qorvo continues to spend money on R&D and provides new progressive semiconductor course of applied sciences and circuit design, the gross sales development would cease. The administration has already provided a number of generations of GaAs, GaN, BAW, and floor acoustic wave course of applied sciences. I count on that the identical engineers will design a brand new technology of gadgets.

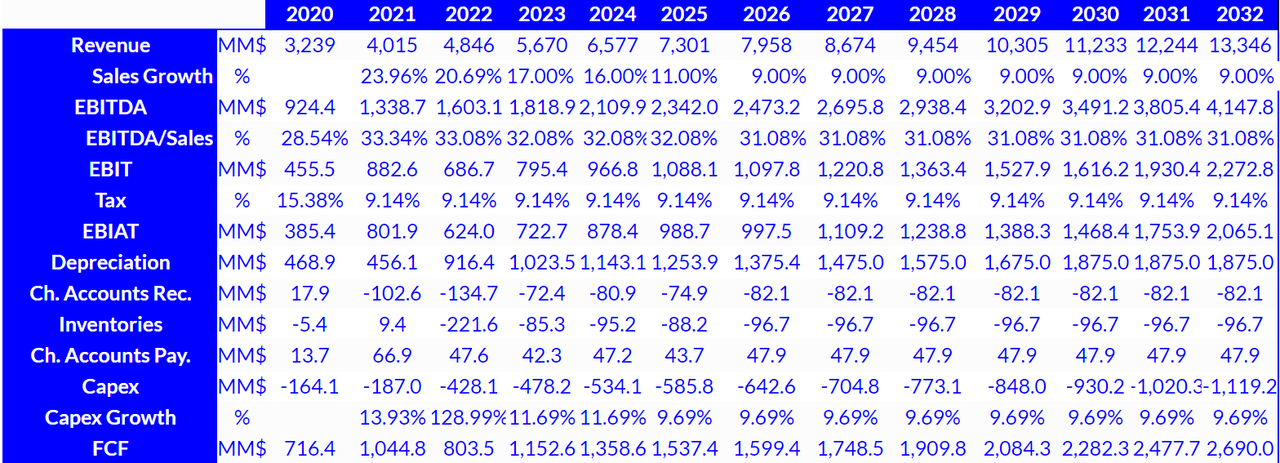

Beneath this case state of affairs, I envisage gross sales development of 9% from 2026 to 2032, an EBITDA/Gross sales ratio near 31%, and taxes round 9%. If we additionally foresee capital expenditures development of round 9%, the free money circulation would develop from $1 billion in 2021 to $2.6 billion in 2032:

Supply: DCF

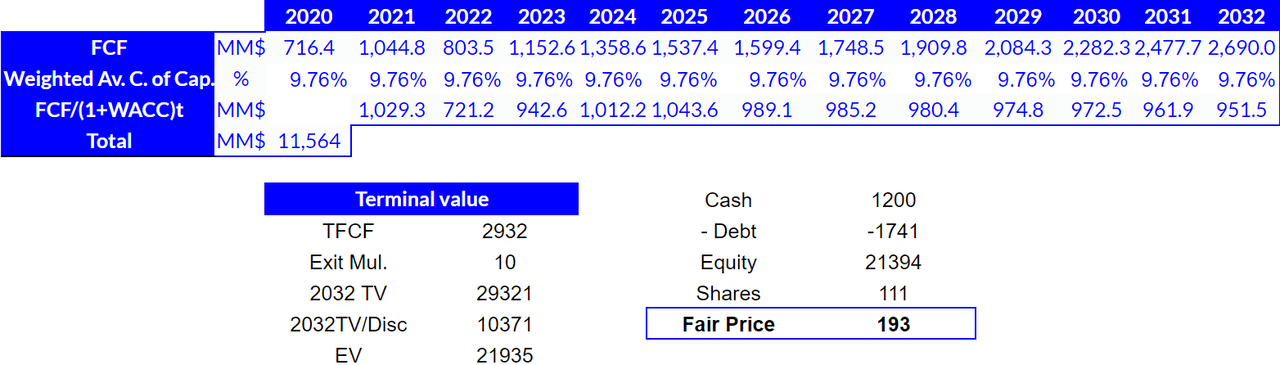

My figures are proven within the mannequin beneath. I obtained a good enterprise worth of $21 billion with an exit a number of of 10x and a terminal FCF of $2.9 billion. The implied share worth could be equal to $193:

Supply: DCF

Dangers From Massive Prospects Together with Apple (AAPL) And Huawei Applied sciences Co., Ltd. In Addition To Contracts With Authorities-sponsored Applications

In 2021 and 2020, Qorvo reported that Apple Inc. was liable for 30% of the overall quantity of gross sales. Huawei additionally represented greater than 5% of the overall quantity of income. I’m really fairly involved about these purchasers. Have in mind that in the event that they resolve to cease working with Qorvo, the decline within the gross sales development may very well be vital:

Collectively, our two largest finish prospects accounted for an combination of roughly 39%, 43% and 47% of our income for fiscal years 2021, 2020 and 2019, respectively. If demand for his or her merchandise will increase, our outcomes are favorably impacted, whereas if demand for his or her merchandise decreases, they could cut back their purchases of, or cease buying, our merchandise and our working outcomes would endure. Supply: 10-Okay

There are different dangers. Qorvo receives a big sum of money from United States government-sponsored packages. They are often topic to cancellations or delays, which might cut back the free money circulation expectations. Consequently, traders might cut back their investments within the firm, and the inventory worth would almost certainly decline:

We obtain a portion of our income from the USA authorities and from prime contractors on United States government-sponsored packages, principally for protection and aerospace purposes. These packages are topic to delays or cancellations. Reductions in protection and aerospace funding or the lack of a big protection and aerospace program or contract would have a fabric hostile impact on our working outcomes. Supply: 10-Okay

I additionally have to level out a number of provide constraints for laminates and silicon, which can cut back the corporate’s future income. In 2021, the corporate appears to be signing long-term strategic partnerships to supply flexibility within the firm’s provide chain. With that, I can’t actually say whether or not extra provide chain points will seem in 2021:

Throughout fiscal 2021, the semiconductor business skilled provide constraints for sure objects, together with capacitors, laminates, and silicon. We count on the business to handle these constraints over time. Supply: 10-Okay

Lastly, the corporate can be topic to sure import/export controls, tariffs, and different trade-related laws. Lots of Qorvo’s workers work from Asia, which implies that the corporate’s enterprise items could also be affected by the United States-China relations:

As of April 3, 2021, we had roughly 8,400 workers and roughly 700 short-term workers in 21 nations. By area, roughly 50% of our complete workers are situated in the USA, 41% in Asia, 5% in Europe and 4% in Costa Rica. Supply: 10-Okay

Beneath these traumatic assumptions, I’d count on gross sales development to say no from 20% in 2022 to 7.8% in 2032. Apart from, the EBITDA margin would stand at 25% from 2027 to 2032.

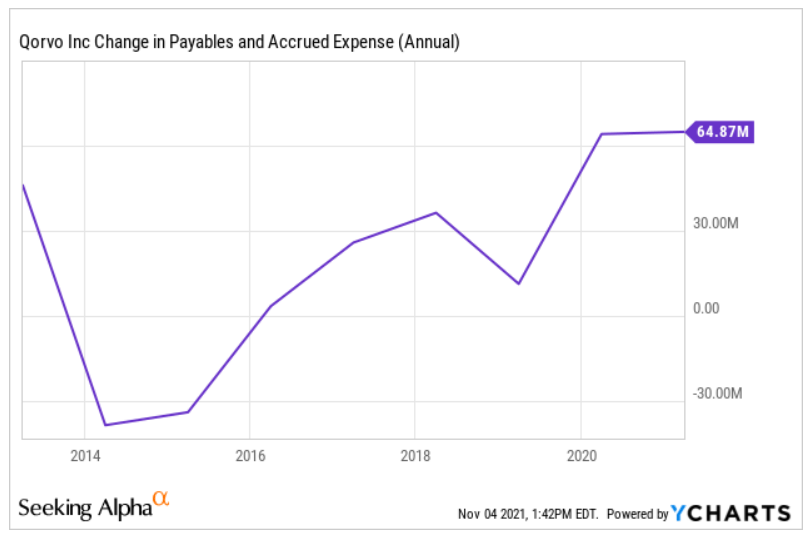

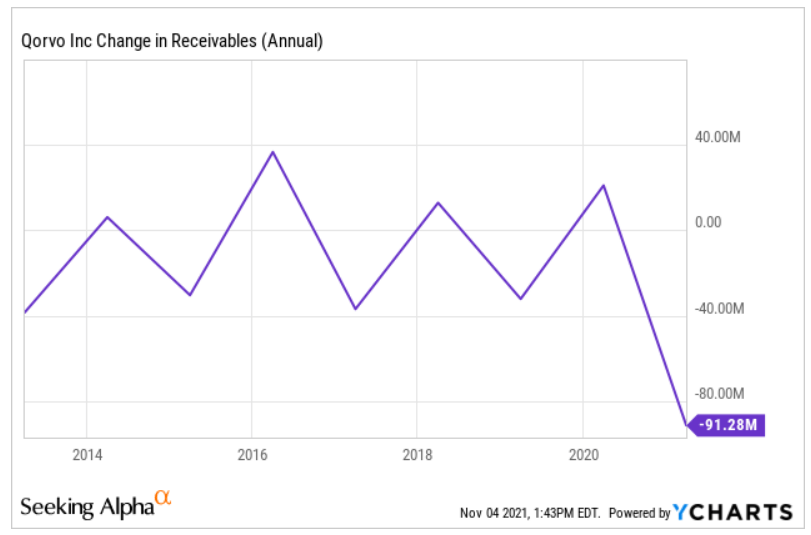

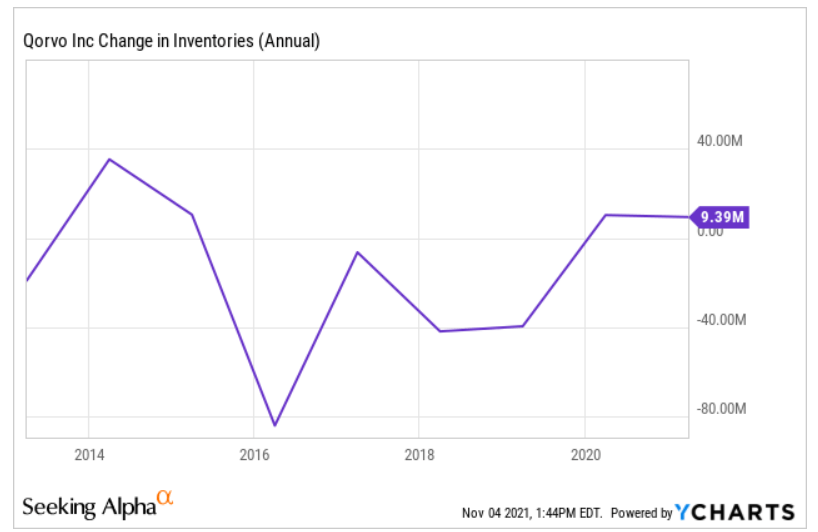

I additionally studied the earlier adjustments in payables, adjustments in stock, and adjustments in accounts receivables. With out going via all my figures, take a look on the following charts, and see that my numbers are aligned with Qorvo earlier monetary figures:

Supply: YCharts

Supply: YCharts

Supply: Elementary Chart Creator

If we additionally assume that capital expenditures will enhance at 10% y/y from 2025 to 2032, I count on the FCF to extend from $1 billion in 2021 to greater than $1.5 billion in 2032:

Supply: DCF

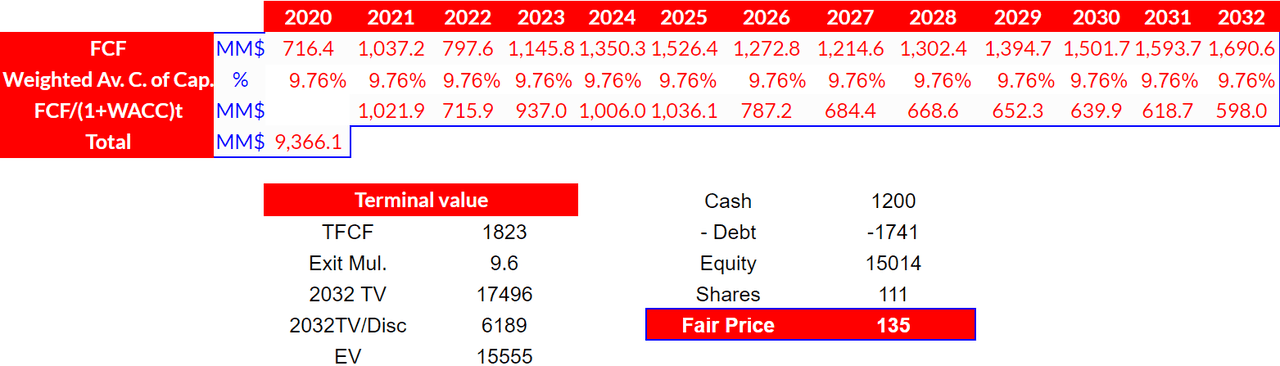

If we apply a WACC of 9.76% and an exit a number of of 9.5x, the enterprise worth would stand at $15.5 billion. If we sum the money in hand and subtract the debt, the truthful worth would stand at $135:

Supply: DCF

Takeaway: There Are Many Dangers

Qorvo’s enterprise mannequin seems fairly progressive and promising. Nevertheless, outcomes from my DCF fashions confirmed that there are a number of dangers to consider. I consider that there’s an upside potential, however I would not advocate the inventory to each investor. If Apple or the US Authorities decides to cease working with Qorvo, income development could also be decrease than anticipated, which can result in a big decline within the firm’s valuation. To sum up, I might be shopping for shares as a result of for me the truthful worth is near $193, however a number of dangers might make the inventory collapse to $135.